The cost of a Fig Loan depends on your state and your size of the loan, as well as on how many successful Fig Loans you have paid off previously.

At Fig, we never charge late fees or late interest. We believe that you should know how much your loan will cost before you submit an application, that way you can decide if the loan is right for you and your budget.

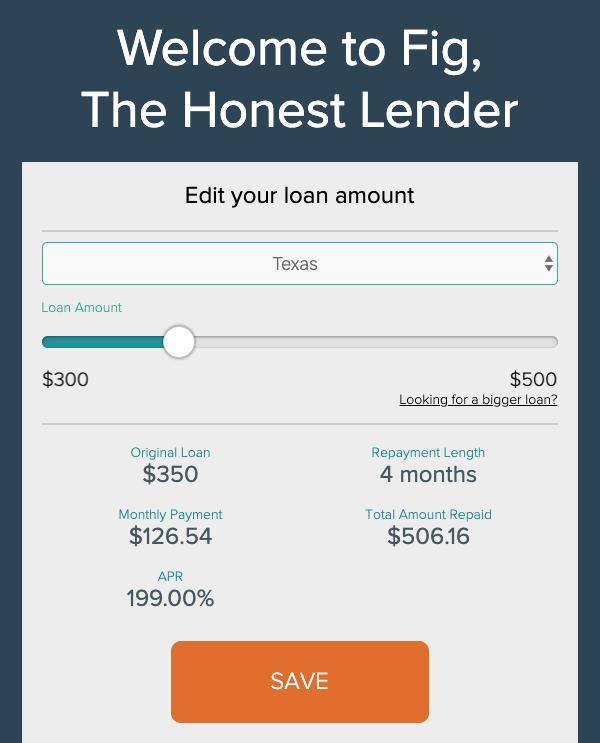

While applying, you can see the total cost of the loan, fees and all. For example, a $350 loan in Texas has 4 monthly payments of $126.54 each, for a total repayment of $506.16. You will not pay more than that total repayment amount. You can see your full fee/payment breakdown clearly in the loan documents presented before you sign.

At this time, payment dates are selected based on the day you accept your application, and the payment date schedule will also be presented in the loan documents before you sign. Depending on the state, payments are either monthly or biweekly.

We also make it easy to reschedule your payments to best suit your needs, and we never charge a fee for changing your payment date.